Dr. Carey W. King

Research Scientist, Energy Institute, The University of Texas at Austin

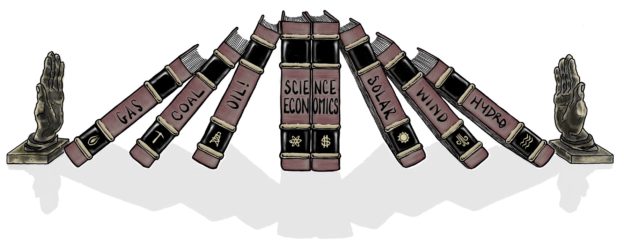

Author of the book The Economic Superorganism.

Researching the role of energy in our past and future

Dr. Carey W King performs interdisciplinary research related to how energy systems interact within the economy and environment as well as how our policy and social systems can make decisions and tradeoffs among these often competing factors. Carey’s research goals center on rigorous interpretations of the past to determine the most probable future energy pathways. He reaches these goals by bridging the gaps between economic and biophysical (or ecological) worldviews of economic growth and structural change.

Carey is a Research Scientist at The University of Texas at Austin and Assistant Director at the Energy Institute. He also has affiliations within the Jackson School of Geosciences, the McCombs School of Business, and the LBJ School of Public Affairs. He is the author of the book The Economic Superorganism and has published technical articles in academic journals such as Ecological Economics, Environmental Science and Technology, Environmental Research Letters, Nature Geoscience, Energy Policy, Sustainability, and Ecology and Society. He has also written commentary for or been interviewed by MarketPlace, American Scientist and Earth magazines, and major newspapers such as the The Hill, Dallas Morning News, Houston Chronicle, San Antonio Express News, and Austin American-Statesman. Dr. King holds a B.S. with high honors and a Ph.D. in Mechanical Engineering, both from the University of Texas at Austin.

(available at online stores: Springer, BookPeople (local Austin), Amazon, etc.)

Book & related interviews and podcasts: Marketplace, Macro N Cheese, Energy Transition Show, Steve Keen & Friends (Jan. 2023, Sept. 2023), USAEE podcast (“The Economy as a Superorganism”: Dec. 2020), Power Hungry podcast, You Don’t Have To Yell (May 2022, December 2022), Financial Insights podcast (November 2020, November 2021), Planet Critical & Energy Central

Book Reviews by Advisor Perspectives (Dick Vodra), Reslience.org/Mud City Press) (Frank Kaminsky), Economics From the Top Down (Blair Fix)

Contact Carey: e: careyking@mail.utexas.edu || p: 512-471-5468

Carey’s Curriculum Vitae: ![]() PDF

PDF

Sign up for Carey’s Newsletter and Donate to Research:

Sign up for Carey’s Newsletter or donate to his research group at University of Texas at Austin:

Carey’s energy and economy systems “primer”:

- The Rising Cost of Resources and Global Indicators of Change (American Scientist, 2015)

The turn of this century saw the cheapest-ever energy and food combined, and here’s why we may never return to those historic low numbers.

“Contemporary discussions of energy resources and technologies are full of conflicting news, views, and opinions from extreme sides of arguments. The average person is understandably confused. Depending on who you listen to, horizontal drilling and hydraulic fracturing have either placed the United States on the verge of energy independence, or exposed the insolvency of oil and gas companies as they spend more money than they collect from sales. Renewable energy technologies can either obviously serve all of our needs, or are a subsidized path to economic ruin.” Read more …

Latest Presentations, Blogs, and Videos

January 15, 2024: The Minimum EROI (or net energy) to Maintain Society has to Define Society

In this blog I point out some existing studies that attempt to link EROI and some aspect of “the economy” or “society”, and then show that due to its overall structure, my Human And Resources with MONEY (HARMONEY) model has an appropriate and sufficient overall structure to holistically provide insights as to how both resource depletion and economic decisions affect EROI and options for economic equality and structure more generally.

October 31, 2022 (op-ed): Energy policy focus on ‘pain at the pump’ ignores history of how we got here

Recent surveys of Americans indicate “threats to democracy” as a top concern, only slightly ahead of usual economic choices of “cost of living” and “jobs and the economy.” These concerns are interrelated between energy and environmental constraints. Yet, most political discourse ignores these connections to the detriment of public understanding. Continue reading …

May 26, 2022: (Video) The Economic Growth Modeling We Need @INET Oxford University, May 2022

View my May 26,022 talk discussing the major insights of my 2022 paper in Biophysical Economics and Sustainability: “Interdependence of Growth, Structure, Size and Resource Consumption During an Economic Growth Cycle”.

March 22, 2022 (Brave New Europe): Why Central Banks Can’t Significantly Raise Interest Rates

Much current investment and policy discussion focuses on inflation and interest rates. The thought is that inflation has been running too high for too long since the onset of the COVID pandemic. Investors and policymakers want to know when, how fast, and to what degree the U.S. Federal Reserve (and other central banks) will raise it target interest rate to lower inflation. The main reason why the Fed won’t be able to raise interest rates to anywhere near historical rates is because of high debt levels. However, the main reason why we have high debt levels is not among the usual reasons given: energy.

In short, in the long-term, the sequence goes from energy to debt to interest rates.

Read the rest of the blog on Brave New Europe …

January 31, 2022 (Brave New Europe): Macroeconomic Modelling of Energy Efficiency: Implications For Reducing Greenhouse Gas Emissions

This is something very basic we need to understand if we wish to stop climate change. Simple solutions are often simple because they are wrong. Energy efficiency will lead to a reduction of energy consumption is one of these.

Continue reading full post on Brave New Europe.

October 13, 2021: Carey quoted in article: “Ted Cruz Says Bitcoin Mining Can Fix Texas’ Crumbling Electric Grid“, VICE

On the idea of using flared natural gas on-site [of oil and gas extraction] to generate power for Bitcoin mining, we could alternatively “Stop issuing flaring allowances and force the industry to actually send the natural gas into the pipeline system,” King said. “Potentially to more NG storage sites that an provide more winter supply in the case of another [major winter storm] Uri-like event.”

September 10, 2021: Carey quoted in article on COIVD energy changes: “Travis County saves nearly $1.3 million due to work from home“, KVUE News Austin, Texas

Despite people spending more time at home, Carey King, an assistant director and research scientist for the Energy Institute at the University of Texas, explained that, nationwide, household energy usage did not spike tremendously during COVID-19.

February 27, 2021 (OPINION): “How economic theories influence energy policy“, Austin American Statesman

“Simply put, more of us need to think about the broader relationship between energy and economic theory”

February 17, 2021 (OPINION: 3 ways Texas can make its electric grid more resilient once power outages end, MarketWatch)

In the face of ERCOT’s rolling blackouts during the 2021 Valentine’s Day winter storm Uri, resist blaming one power source because that detracts from making the entire electricity and energy system reliable. Read more …

December 9, 2020 (Energy Transition Show PODCAST): “The Economic Superorganism” (95 min)

Listen to Carey discuss his book on the podcast the Energy Transition Show, of which host Chris Nelder states: “Heady stuff about the macroeconomics of energy transition!” (and he gives it a Geek Rating of 7.