2024

January 15, 2024: The Minimum EROI (or net energy) to Maintain Society has to Define Society

Several authors have concerned themselves with the possible causal relationship between the energy return on energy invested (EROI) of one or all of the economy’s energy supplies and the state of the economy, or perhaps the stability, structure, or sustainability and well being of “society” more generally. To address this topic one needs to define society, or at least its components in a coherent manner. One way to do this is to coherently link both a biophysical description of natural (energy) resource extraction and use and a full monetary (stock and flow) description of the economy including a behavior for investment, or effective demand (could include a household behavior assumption). Read the full blog …

2023

September 2, 2023 (Steve Keen and Friends PODCAST): The Economic Superorganism

Carey King speaks with Steve Keen about the concept of the economic superorganism, Carey’s book, and how we can improve macroeconomic modeling to include energy and material flows into economics.

January 7, 2023 (Steve Keen and Friends PODCAST): Steve & Friends with Guest Carey King

Carey King speaks with Steve Keen about how we can improve macroeconomic modeling to include energy and material flows into economics.

2022

December 15, 2022 (You Don’t Have to Yell PODCAST): The Connection Between the Energy Supply and Political Polarization

Carey King of the Energy Institute of the University of Texas at Austin discusses how the last 80 years of American history have shown a connection between energy consumption, economic output, and political polarization.

October 31, 2022: Energy policy focus on ‘pain at the pump’ ignores history of how we got here

Recent surveys of Americans indicate “threats to democracy” as a top concern, only slightly ahead of usual economic choices of “cost of living” and “jobs and the economy.” These concerns are interrelated between energy and environmental constraints. Yet, most political discourse ignores these connections to the detriment of public understanding. Continue reading …

October 10, 2022: How Does Global Energy Consumption scale with GDP and Mass? A Biophysical Perspective

The data for total global mass accumulation in the economy (the stocks of mass that are our buildings, roads, vehicles, and other infrastructure and products) and gross world product (GWP) have a very similar pattern with respect to total primary energy consumption. Before about 1973, energy consumption increases at about the same rate as mass and GWP of the economy, but after 1973 it increases more slowly. I describe a biophysical economic perspective on these data, and how this is exactly what we’d expect from observing biological growth.

May 26, 2022

(Video) The Economic Growth Modeling We Need @INET Oxford University, May 2022

March 19, 2022: Why Central Banks Can’t Significantly Raise Interest Rates

Investors and policymakers want to know when, how fast, and to what degree the U.S. Federal Reserve (and other central banks) will raise it target interest rate to lower inflation. The main reason why the Fed won’t be able to raise interest rates to anywhere near historical rates is because of high debt levels. However, the main reason why we have high debt levels is not among the usual reasons given: energy. In short, in the long-term, the sequence goes from energy to debt to interest rates.

Read the rest of the blog on Brave New Europe …

January 31, 2022: Macroeconomic Modelling of Energy Efficiency: Implications For Reducing Greenhouse Gas Emissions

This is something very basic we need to understand if we wish to stop climate change. Simple solutions are often simple because they are wrong. Energy efficiency will lead to a reduction of energy consumption is one of these.

Continue reading full post on Brave New Europe.

2021

December 5, 2021: Read a full-length blog summary of 5 major insights from my latest paper on my economic growth model “HARMONEY”:

5 insights:

- Insight #1: Efficiency begets more consumption and accumulation, not less (Jevons Paradox)

- Insight #2: Economy Shows Same Energy-Size Scaling as Biological Growth

- Insight #3: Enhanced Interpretation of Decoupling Resource Consumption from GDP

- Insight #4: Labor (wage share) vs. Capital (capital share) vs. Resource Consumption Tradeoff

- Insight #5: Evolution of Economic Structure and Complexity

King, Carey W. (2022) Interdependence of Growth, Structure, Size and Resource Consumption During an Economic Growth Cycle, Biophysical Economics and Sustainability, volume 7, Article number: 1. Free online access to paper: website link and pdf.

October 13, 2021: Carey quoted in article: “Ted Cruz Says Bitcoin Mining Can Fix Texas’ Crumbling Electric Grid“, VICE

On the idea of using flared natural gas on-site [of oil and gas extraction] to generate power for Bitcoin mining, we could alternatively “Stop issuing flaring allowances and force the industry to actually send the natural gas into the pipeline system,” King said. “Potentially to more NG storage sites that an provide more winter supply in the case of another [major winter storm] Uri-like event.”

September 10, 2021: Carey quoted in article on COIVD energy changes: “Travis County saves nearly $1.3 million due to work from home“, KVUE News Austin, Texas

Despite people spending more time at home, Carey King, an assistant director and research scientist for the Energy Institute at the University of Texas, explained that, nationwide, household energy usage did not spike tremendously during COVID-19.

February 27, 2021 (OPINION): “How economic theories influence energy policy“, Austin American Statesman

“Simply put, more of us need to think about the broader relationship between energy and economic theory”

February 17, 2021 (OPINION: 3 ways Texas can make its electric grid more resilient once power outages end, MarketWatch)

In the face of ERCOT’s rolling blackouts during the 2021 Valentine’s Day winter storm Uri, resist blaming one power source because that detracts from making the entire electricity and energy system reliable. Read more …

2020

December 9, 2020 (Energy Transition Show PODCAST): “The Economic Superorganism” (95 min)

Listen to Carey discuss his book on the podcast the Energy Transition Show, of which host Chris Nelder states: “Heady stuff about the macroeconomics of energy transition!” (and he gives it a Geek Rating of 7.

December 9, 2020 (Center for the Advancement of the Steady State Economy BLOG): “The Impact of Evolutionary Pressures on Economic Narratives”

December 6, 2020: Explanation of the Jevons Paradox (or “backfire” effect) using the HARMONEY model

In this blog I use my HARMONEY (“Human And Resources with MONEY”) economic growth model (also see this free early version) to demonstrate the dynamics of the Jevons Paradox: that an increase in end-use efficiency leads to an increase in total resource extraction, rate of resource depletion, and final level of depletion.

Read the full blog …

December 3, 2020 (USAEE PODCAST): “The Economy as a Superorganism: How much Can We Control it?” (26 min)

In a podcast for the United States Association for Energy Economics, Carey discusses content from his new book, The Economic Superorganism: Beyond the Competing Narratives on Energy, Growth, and Policy, that relates to how some economists, ecologists, and other scientists view the economy as a system that has evolved in the same manner as biological organisms. For reasons we don’t necessarily fully understand, the economy seems to pursue what is known as the maximum power principle and increasing rates of work output (in the thermodynamic sense of work). Carey discusses some of the philosophical and policy-related questions arising out of this concept, such as whether there is some inherent growth imperative that is making it difficult for we, as humans, to invoke enough agency to pursue long-term goals such as a low-carbon energy transition.

November 23, 2020 (Robert Bryce’s Power Hungry PODCAST): Carey King, The Economic Superorganism (1hr 15 min)

Bryce’s Summary: Carey King is a research scientist and assistant director of the Energy Institute at the University of Texas. In this episode, Robert talks with King about his new book, The Economic Superorganism: Beyond the Competing Narratives on Energy, Growth, and Policy, what he sees as the “hollow narratives” about energy and power systems, Thomas Malthus, why King calls himself a “finite earther,” the relationship among GDP, energy, and human well-being, and why the global economy should be viewed as a “superorganism.”

Podcast link: http://robertbryce.com/episode/carey-king-the-economic-superorganism/

November 12, 2020 (PODCAST): Energy, Economics and Society: a chat w Carey King

This is a discussion with financial advisor Jim Cox for his podcast Human Insights with James Cox. We discuss ideas in my book, The Economic Superorganism, on how we can relate the trends and structure of the economy to changes and properties of the energy system. It is a nice free-flowing conversation.

November 11, 2020 (USAEE Webinar): Can Macroeconomic Models really Model a Low-Carbon Energy Transition?

A discussion with Carey King, Steve Keen, and David Daniels as part of the webinar series of the United States Association for Energy Economics.

Summary: Are the right theories and assumptions being used to integrate the economics of energy and climate change? Can the current crop of economic models (e.g., IAMs) effectively inform energy and carbon policy? What are the economic theories and assumptions behind these models, and are they up to the task? If not, what economic theories and frameworks can improve our modeling of energy and economic interactions? Join this webinar for insights into the practical and theoretical difficulties and possibilities for modeling the important linkages between energy consumption and economic growth and distribution. (Direct YouTube video link)

Summary: Are the right theories and assumptions being used to integrate the economics of energy and climate change? Can the current crop of economic models (e.g., IAMs) effectively inform energy and carbon policy? What are the economic theories and assumptions behind these models, and are they up to the task? If not, what economic theories and frameworks can improve our modeling of energy and economic interactions? Join this webinar for insights into the practical and theoretical difficulties and possibilities for modeling the important linkages between energy consumption and economic growth and distribution. (Direct YouTube video link)

January 2, 2020 (BLOG): How Wages are Linked to Energy Consumption: Data and Theory

How do economic analyses account for the roles and impacts of both the cost and quantity of natural resource consumption?

Many researchers, including myself, think we must explicitly consider the use of natural resources if we are to understand economic growth and the distribution of the stocks (e.g., debt) and flows (e.g., wages, profits) of money within the economy.

I have recently published a paper on my economic growth model that consistently and simultaneously accounts for both the use of natural resources, such as energy, and debt.

The paper sheds new light on some of the most important contemporary economic trends in the United States and other economies of the OECD. In particular, the model provides the foundation to directly link changes in the rate of energy consumption to increases in wage inequality and debt that began during the 1970s.

Read the full blog here …

2019

May 2019: PODCAST interview by Dr. David Spence of University of Texas at Austin for his Energy Tradeoffs website: Economic Growth, Inequality & Decarbonization

Here I speak with David Spence, Baker Botts Chair in Law at the University of Texas School of Law, and Professor of Business Government & Society at the McCombs School of Business. This is part of his effort, with other colleagues, to promote informed discussion and education about the tradeoffs when choosing different energy resources and technologies. Length: 20 minutes.

May 2019: PODCAST interview: James A. Cox (financial advisor): Economic Models for the Anthropocene Era: a chat with Carey King

Here I speak with Jim Cox (https://jamesacox.com) for his Financial Insights podcast. Jim is a financial advisor with First Financial Group in Philadelphia. We talk about the state of macroeconomic modeling and some of the insights from my macroeconomic modeling. Length: 43 minutes.

January 17, 2019: The battle of energy-economic narratives is tainting the Green New Deal

An op-ed in The Hill discussing how people use their “energy and economic narratives” to discuss the feasibility, or lack thereof, of the Green New Deal.

2018

December 11, 2018: Texas power costs: What’s the cheapest way to generate electricity?

This is a nice story in the Dallas Morning News about our Energy Institute study, The Full Cost of Electricity, summarizing our updated calculations for the levelized cost of electricity (LCOE) across Texas and the U.S. as well as our comparison of state level financial support, or subsidies for electricity in Texas and California.

“There’s no consensus on whether you should call something like that [extending transmission lines to West Texas] a subsidy or state financial support. Texas seems more agnostic in terms of the energy type, whether it’s renewables or hydrocarbons. Is this a thing that you are going to build and create jobs and help the economy? Well, then, good.” — Carey King

November 5, 2018: Artificial Intelligence and the Utility Monster: It’s the Economy Stupid

(also linked on Resilience.org)

In an extreme world with markets for everything, each of us becomes an automaton responding to price signals to maximize collective utility, or GDP, that might have very little to do with our personal well-being.

How could we know if we have allowed the economy to simply become a GDP maximizing utility monster?

Read the full post here …

March 6, 2018: Our Electric Future (Big Ideas of McCombs School of Business)

In a new multidisciplinary study, researchers find the answer to our electric future is blowing in the wind — and burning natural gas. A Q&A in two parts.

Read the article: https://medium.com/texas-mccombs/our-electric-future-b0c46bdb3aba

January, 2018: A Lack of Systematic Thinking Keeps America from Staying Great

King, Carey W. and Rhodes, Joshua D. A Lack of Systematic Thinking Keeps America from Staying Great, Energy Institute Commentary, January, 2018: online link.

Our economic system operates within intellectual, social, and physical constraints. Each of these constraints can feedback to affect the others. To produce more goods and services we have to 1) know how to produce them, 2) make them desirable, acceptable and affordable, and 3) have the required natural resources. The finite size of the Earth increasingly affects socioeconomic outcomes across the globe, including within the developed economies.

Ecologists, anthropologists, and systems scientists have anticipated this since the 1970s. However, the physical constraints on societal and economic organization and equality are largely unappreciated and misunderstood. Read more …

2017

December 14, 2017: West Texas Talk – The State of Renewable Energy

On this episode of West Texas Talk we hear from Carey King on the state of renewable energy in Texas. King is the Assistant Director of the Energy Institute at the University of Texas at Austin which looks at the technology, policy and economics of energy.

In this interview you will hear about the technology that’s playing a role in renewables development, what natural gas means when we’re talking about renewable’s growth, and what 2018 could mean for the industry in Texas.

June, 2017: Food, energy as sources of U.S. polarization

Op-ed linking energy and food trends to economic, social, and political polarization. Food, energy as sources of U.S. polarization.

A version of this op-ed appeared in the San Antonio Express News, Corpus Christi Caller Times, and Psychology Today.

2016

2016, December 14: Energy Transition Show – Podcast Discussion of Resources and Economy

Link: http://energytransitionshow.com/episode-32-resources-and-economy/

2016, December 8: Pipeline, Standing Rock, Conflict is all about Power

The following is the text of an opinion editorial I wrote that was placed in many major Texas newspapers on December 8, 2016. I also include comments received via e-mail, from readers, and only include names when persons specifically gave permission to do so.

Links to version in Austin American Statesman, Houston Chronicle, Dallas Morning News

The recent decision by the President Barack Obama’s Administration, via the Army Corps of Engineers, to ask for a more in-depth environmental impact statement regarding a final section of the Dakota Access oil pipeline represents a clash of power. The simple story is one of environmental and health concerns, but in reality the full story is much more. It is a continuation of the populist fervor building up in the United States. It is a continuation of the pursuit of infinite growth. It is a story of physical power, political power and economic power.

Click here to read full op-ed.

2016, November 6: Relations Between Energy and Structure of the US Economy Over Time

The findings of the paper described in this blog have important implications for economic modeling as they help explain how fundamental shifts in resources costs relate to economic structure and economic growth.

As the cost of food and energy in the U.S. decreased from 1947 to 2002, the U.S. economy became more “redundant” and less “efficient”. However, once the cost of food and energy started increasing after 2002, the trend reversed.

Click here to read the full post …

2016, September 20: The Most Important and Misleading Assumption in the World

Part 2 of 2: A blog written for the Cynthia and George Mitchell Foundation (see link here).

Part one of this blog post explained how macroeconomic models are flawed in a fundamental way.

These models are coupled to models of the Earth’s natural systems as Integrated Assessment Models (IAMs) that are used to inform climate change policy. Most IAM results presented in the Intergovernmental Panel on Climate Change (IPCC) reports show climate mitigation costs as trivial compared to gains in economic growth.

The referred to “elephant in the room” (from part one of this series) is the fact that economic growth is usually simply assumed to occur.

Click here to read the full post …

2016, September 12: Macro and Climate Economics: It’s time to Talk about the “Elephant in the Room”

A blog written for the Cynthia and George Mitchell Foundation (see link here).

If we want to maximize our ability to achieve future energy, climate, and economic goals, we must start to use improved economic modeling concepts. There is a very real tradeoff of the rate at which we address climate change and the amount of economic growth we experience during the transition to a low-carbon economy.

If we ignore this tradeoff, as do most of the economic models, then we risk politicians and citizens revolting against the energy transition midway through.

Click here to read the full post …

2016, September 2: Keep Austin Weird by Making Austin Wealthy … all of it!

King, Carey W. (2016) Make Austin Wealthy: White Paper for the City of Austin Office of Sustainability‘s Rethink Austin campaign.

King, Carey W. Keep Austin Weird by Making Austin Wealthy … all of it. Opinion Editorial in the Austin American Statesman, September, 2, 2016.

“Keep Austin Weird. The mantra is everywhere – on shirts, coffee mugs, and bumper stickers. And yet Austin seems to be losing its weirdness.

Downtown music venues are struggling. Leslie, the scantily clad, homeless, former mayoral candidate, has passed. Perhaps the clearest sign of losing our weirdness is that Austin hosts a Formula 1 race – a combination of glamour and technology that leaves no trace of “weird” in its tracks. But such are the challenges of a growing city.

Some weirdness remains. Just take a look at the early mornings at Barton Springs pool. Austin is the largest city that doesn’t host a major league sports team. And we still have vibrant movie rental stores.

But I think we need a new mantra: Make Austin Wealthy – and by “wealthy,” I mean emphasizing all kinds of assets, and by “Austin” I mean every person and neighborhood in Austin.”

Click here to read further …

2016, June 23: Rediscovering the Energy-Economy Connection (on OurEnergyPolicy.org)

The world has experienced profound changes recently regarding energy and the economy. Fossil fuels, while still abundant, are becoming more costly to develop as the most easily-accessible resources become depleted. Many renewable energy technologies are becoming less costly due in part to market forces as well as supportive state and federal energy policies. These technologies however would require massive capital investment to replace fossil fuels at current scale. Global demand for energy continues to climb while advanced economies are becoming less energy-intensive when measured per unit of GDP.

Meanwhile, a global financial crisis as well as mounting public and private debt have cast a shadow of lingering uncertainty over the world economy. Conventional thinking suggests an eventual return to “normal.” But slowing growth, increasing inequality, and a sense that an apparent recovery remains fragile are driving concerns that the world has entered a new era, where classic economic rules and tools may no longer apply.

In his book The End of Normal – The Great Crisis and the Future of Growth, noted economist James Galbraith explores how these trends may be related and converging to define a new normal. He describes how the role of energy in economic activity was well-known in classical political economics, but was essentially forgotten in the growth theories that have dominated economic thinking for the past half-century or more.

In particular, the decades immediately following World War II were a time of unparalleled economic growth and increasing income equality. Energy production, consumption, and efficiency all saw significant increases, and energy expenditures as a percentage of GDP steadily declined. But, as shown by my own work (here, here and here), around the year 2000, a 100+ year trend of continually declining energy and food expenditures came to an end. Re-discovering the energy-economy connection is important to making sense of the recent past and the outlook for the future.

2016, April 15: Relating energy flows to money flows for the energy sector of the world

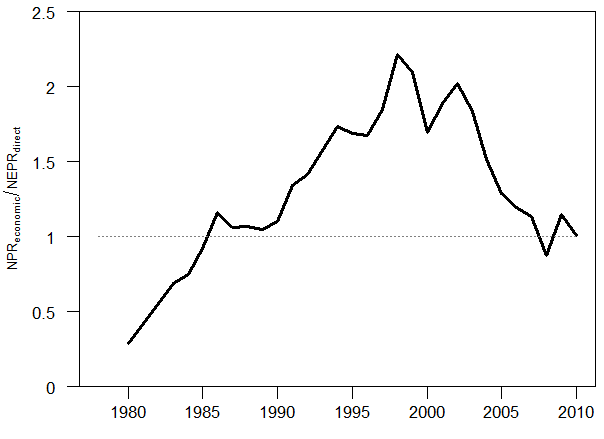

Figure 1 is perhaps the most interesting chart I have ever made. The purpose of this figure (from my publication here) is to provide context into metrics of net energy and see how they relate to economic data. Here, I’m asking a fundamental question: should our (worldwide) society be able to leverage money more than we can leverage energy? My hypothesis is “no” and would be represented by values < 1 in Figure 1. Clearly the plotted ratio of ratios in Figure 1 is not less than one (for all years) per my hypothesis, so why might this be the case? As I discuss below, understanding the data in Figure 1 is crucial for making better macroeconomic models of the economy that properly account for the role of energy.

Figure 1. This is a ratio of how much the worldwide economy leverages money spent by the energy sector relative to how much surplus energy is produced by the energy sector itself. Specifically this calculation (using world numbers) = (GDP/money spending on energy by the energy system) / [ (world primary energy production – energy spending by the energy system) / energy spending by the energy system)].

CONTINUE reading the full post …

2016, March 3: How much can the next president influence the U.S. energy system?

There have been dramatic changes in the U.S. energy system under our current president – a big drop in the use of coal, a boom in domestic oil and gas development from fracking, and the rapid spread of renewable energy. But in terms of influencing energy technology deployment, the next president will have a lot less influence than you might expect. When it comes to educating U.S. citizens on energy’s relationship to the broader economy, though, the next president could have a great impact. But I’m not holding my breath. In fact, I’d say it’s likely not going to happen. Here I pose a few relevant questions about energy and the economy that could be asked of our next president and suggest some answers.

2016, February 21: The stay on the Clean Power Plan: A mountain out of a molehill

Much of the hyperbole over the Supreme Court’s stay of the EPA’s Clean Power Plan (CPP) is making a mountain out of a molehill. The CPP is very significant politically, legally, but its CO2 goals are trivial in the grand scheme of sustainable consumption patterns, technological capability, stated goals (not commitments) at Conference of Parties global climate talks. The CPP targets are a piece of cake. And I say this as someone that is not a techno-optimist in the sense that technology alone will not solve all socioeconomic problems.

2015

2015, September 30: Interview and story on the U.S. Crude Oil Export Ban

Dr. King is quoted in a recent story discussing crude oil exports (An Industry Divided: Refiners Take On Big Oil In Fight Over Crude Oil Export Ban) and within a radio-spot for the Texas Standard.

2015, May 26: What should Texas do about Integrated Water-Energy Policy Decisions?

This is a guest blog for The Cynthia and George Mitchell Foundation. In the blog I discuss the ongoing lawsuit between the Texas Farm Bureau and the Texas Commission on Environmental Quality regarding the allocation of water rights in Texas’ Brazos River Basin. One of the issues is whether or not electric power generators should have guaranteed access to water during droughts even if they do not have water rights more senior than some farmers. I also close with numbers about how much water is consumed for power generation in Texas, and the quantities are much smaller than stated in the Texas State Water Plan.

2015, February 23: Just how big is an XL pipeline?

Considering the topic of the proposed Keystone XL pipeline to be built by TransCanada, just how “extra large”, or XL, is it? In analyzing this question, most analyses focus so much on the small question of the relative impact of the pipeline that they miss the extra large picture: more pipelines mean more shipping options, more options provide (possibly) cheaper options, and cheaper options enable more consumption. In short, more begets more, not less.

2014

2014, December 1: RE < C: The end of a project and the stereotype of Silicon Valley

Google’s foray into energy, the “RE<C = Renewable Energy less than Coal” was typical of the Silicon Valley mentality that is used to “solving” some technological problem quickly, selling the company or idea to a larger company, and then moving on to the next great app. Whether it is RE<C or making advanced biofuels from algae or cellulosic feedstocks, the Silicon Valley stereotype thinks the “energy problem” will be solvable just like cellular phones and that their “energy days” will be another line on their CV.

2014, September 8: Why only comparing energy prices is not enough: Case Study of Residential PV and electricity in Germany and the United States

2014, April 1: Do the math – no, the U.S. can’t punish Putin by exporting oil and gas

2013, August 27: Reaching “peak bashing” of peak oil

2013, January: What goes down: Stein’s Law and the cost of energy

2012, September 25: Changing trend in energy and food-expenditure trends signify future realities

Other Websites of Interest

ourfiniteworld.com – The author of Our Finite World is Gail Tverberg. She is a researcher focused on figuring out how energy limits and the economy are really interconnected, and what this means for our future. Her background is as a casualty actuary, working in insurance forecasting.

peakprosperity.org – Chris Martenson’s site for insights for prospering as our world changes

planet3.org – Honest, wide-ranging, scientifically informed conversation about sustainable technologies and cultures, toward a thriving future

resilience.org – Resilience.org aims to support building community resilience in a world of multiple emerging challenges: the decline of cheap energy, the depletion of critical resources like water, complex environmental crises like climate change and biodiversity loss, and the social and economic issues which are linked to these.